Navigating the financial landscape of a new country can be daunting, but at Gordion Partners, we are committed to simplifying this journey for our clients. Opening a bank account in Turkey, whether for personal use or business ventures, is a crucial step for foreigners aiming to settle or invest here. The process involves understanding the specific requirements, documentation, and local banking procedures. Our comprehensive guide is designed to provide clarity, ensuring a seamless experience for expatriates and investors alike. Trust Gordion Partners to equip you with the knowledge and assistance you need to establish your financial foundation in Turkey efficiently and effectively.

Understanding Banking Options for Foreigners in Turkey

Turkey offers a diverse array of banking options tailored to meet the needs of foreigners, ranging from public and private banks to international banking institutions with branches in the country. Public banks like Ziraat Bank and Halkbank are known for their extensive network and favorable terms, while private banks such as Garanti BBVA and Is Bankasi offer advanced digital services and comprehensive customer support. Additionally, international banks like HSBC and Citibank provide valuable global banking solutions for expatriates. Understanding these options helps newcomers choose the most suitable bank that aligns with their financial needs and expectations, ensuring a smoother banking experience in Turkey.

Once you’ve identified the type of bank that best suits your needs, the next step involves understanding the account types available to foreigners. Typically, these include basic current accounts, savings accounts, and foreign currency accounts, each providing different benefits like easy access to daily transactions, higher interest rates for savings, or the ability to hold money in currencies like USD or EUR. Some banks also offer premium accounts with added perks such as lower transfer fees, personalized banking services, and exclusive investment opportunities. It’s crucial to assess your individual financial goals and daily banking requirements when selecting an account type, in order to maximize your banking benefits while living in Turkey.

To open an account, you will need to gather specific documentation, including a valid passport, proof of residence in Turkey, a Turkish tax identification number, and sometimes a reference letter from your home country’s bank. The process generally begins with a visit to your chosen bank’s local branch, where a bank representative can assist you in completing the necessary forms and verify your documents. Some banks may also offer online application options, allowing you to initiate the process remotely. Once your application is approved, you will receive your banking details, debit card, and relevant online banking credentials, enabling you to manage your finances conveniently. At Gordion Partners, we provide hands-on support throughout this process, ensuring you fulfill all requirements smoothly, and establish a secure and efficient banking relationship in Turkey.

Step-by-Step Guide to Opening a Bank Account in Turkey

The first step in opening a bank account in Turkey is selecting a suitable bank. Turkey boasts a variety of banks, including both local and international institutions, each offering different services, banking fees, and benefits tailored to diverse needs. Start by researching and comparing banks to determine which one aligns with your financial goals. Factors to consider include the availability of English-speaking staff, online banking facilities, and the bank’s presence in your locality. Meeting with a bank representative can also provide insight into their customer service quality and the specific requirements for foreign clients.

Once you have chosen a bank, the next step is to prepare the required documentation. Generally, banks in Turkey ask for a completed account application form, a valid passport, a Turkish tax number, and proof of address, which can be a utility bill or a rental contract. Some banks may also request additional documents like a residence permit or proof of income, especially for those seeking to open business accounts. It’s important to gather all necessary paperwork beforehand to streamline the process. At Gordion Partners, we assist our clients in securing these documents and provide guidance on how to obtain a Turkish tax number, ensuring a smooth and efficient account opening experience.

After preparing your documentation, the final step is to visit the bank to submit your application and complete the account opening process. During your visit, you will meet with a bank officer who will review your documents, ask for any additional information needed, and guide you through signing the necessary forms. Some banks may also require an initial deposit, which varies depending on the type of account you are opening. Once everything is in order, your bank account will be activated, and you will receive your account details and bank cards. At Gordion Partners, we accompany our clients throughout this stage, offering translation services if needed and ensuring that the entire procedure is as seamless as possible. Ensuring that you understand your new bank’s terms and services will help you manage your finances effectively from day one in Turkey.

Essential Documents Required for a Turkish Bank Account

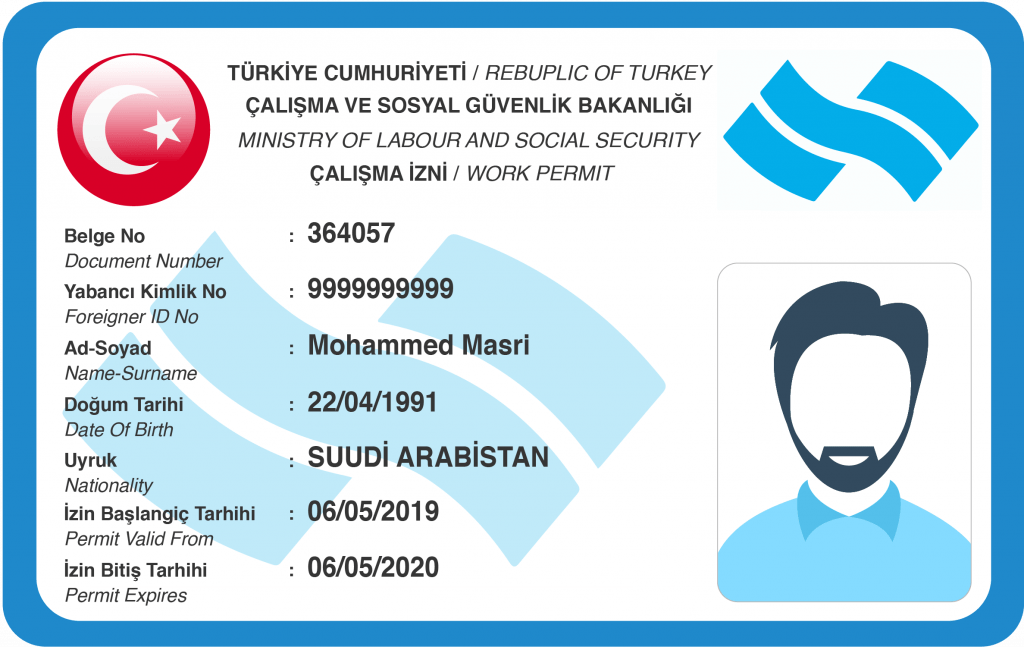

To open a bank account in Turkey, it is essential to prepare a set of key documents. These typically include your passport, a valid residence permit, and a Turkish tax identification number. Some banks may also require proof of address, which can be satisfied with a utility bill or a rental agreement. In certain cases, you may need to provide additional documents like a work permit or a social security number. Ensuring you have all these documents in order is crucial for a smooth account opening process, and Gordion Partners is here to assist you every step of the way, making sure you meet all requirements promptly and efficiently.

Obtaining a Turkish tax identification number (TIN) is a fundamental step before opening a bank account. This number can be acquired by visiting a local tax office with your passport, and in some cases, your residence permit. The process is typically straightforward and free of charge, but it may vary slightly depending on the region. Gordion Partners can facilitate this process for our clients, ensuring that you secure your TIN without any hurdles. Additionally, some banks may offer the service of obtaining a TIN on your behalf, streamlining the entire procedure. Your TIN will be used for various financial transactions, emphasizing its importance in your journey to establishing a bank account in Turkey.

Once you have gathered all necessary documents, the next step is to visit your chosen bank to initiate the account opening process. It’s advisable to schedule an appointment beforehand, as this can save time and ensure that a dedicated representative is available to assist you. During your appointment, you will be required to fill out various forms and provide detailed information about your financial situation and intended account usage. Gordion Partners can accompany you during this meeting to ensure all forms are correctly completed and to translate any information you might not fully understand. By having a complete and correct set of documents and professional support, opening a Turkish bank account can be a seamless experience, allowing you to focus on your new ventures in Turkey.