Navigating the intricate landscape of property acquisition in Turkey can be a complex endeavor, particularly for foreign investors and those seeking citizenship through real estate investment. At Gordion Partners, we specialize in providing comprehensive advisory services designed to streamline this multifaceted process. Our guide to the Turkish property purchase process aims to demystify the legal, financial, and bureaucratic steps involved, empowering you with the knowledge and confidence to make informed decisions. Whether you’re a prospective homeowner, a seasoned investor, or someone considering Turkey’s citizenship by investment program, our expert insights and tailored guidance will ensure a smooth and successful property acquisition journey.

Legal Requirements and Due Diligence

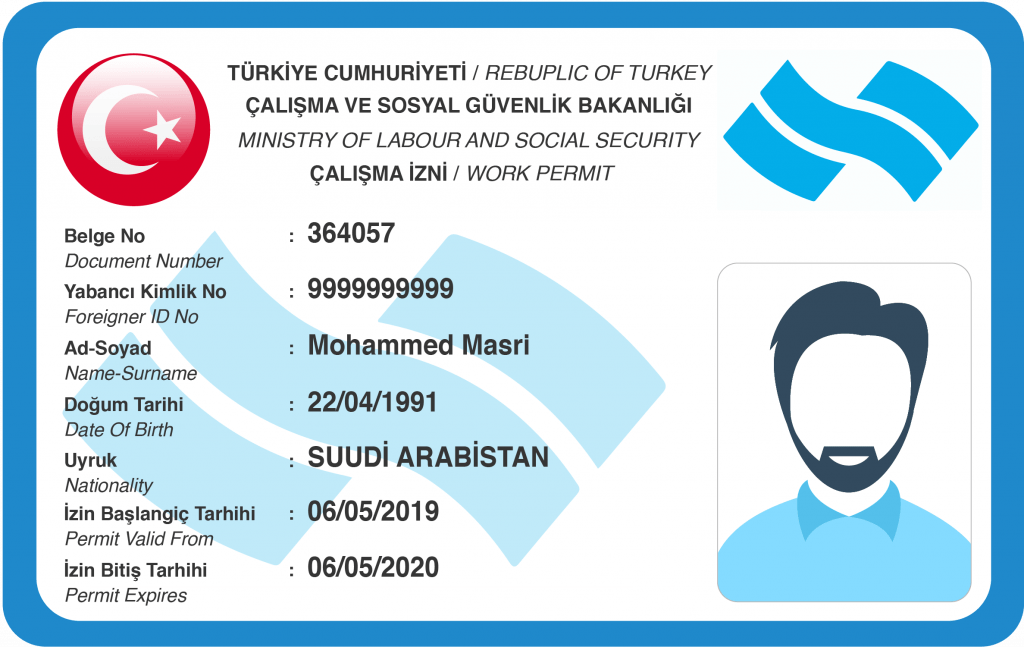

Understanding the legal requirements and conducting thorough due diligence is paramount when purchasing property in Turkey. Foreign buyers must first ensure eligibility, as certain nationalities may face restrictions on property ownership. Essential documents such as a valid passport, a Turkish tax number, and proof of funds must be presented. Additionally, it’s critical to verify the property’s title deed (Tapu) at the Tapu Office, ensuring it is free of any encumbrances or legal issues. Engaging a qualified lawyer to navigate these legal intricacies and to conduct a comprehensive due diligence check can safeguard your investment and help facilitate a seamless transaction process.

Securing the property also involves understanding zoning laws and building regulations specific to the location. It is essential to confirm that the intended use of the property complies with local zoning plans and that there are no upcoming municipal projects that could affect the property’s value or use. Buyers should also commission a detailed property survey to assess the condition and verify the boundaries, thereby avoiding any future disputes. Conducting a thorough review of any existing leases, building permits, and potential liabilities will further ensure that there are no hidden complications. At Gordion Partners, we assist clients in navigating these regulations and coordinating with local authorities to ensure all legal requisites are met effectively.

Another key aspect of due diligence involves understanding and calculating all associated costs, including property taxes, notary fees, and potential maintenance charges. It is also crucial to consider the financial implications of insurance requirements and possible renovation expenses to bring the property to your desired standards. Currency exchange rates and banking logistics should be taken into account, as they can significantly impact the overall investment cost. At Gordion Partners, we emphasize a holistic approach by conducting a comprehensive financial analysis tailored to your specific needs, ensuring you are fully aware of all economic factors before finalizing your purchase. Our expert team is dedicated to providing clarity and precision, enabling you to make an informed and confident investment decision in Turkey’s real estate market.

Financing Options for Foreign Buyers

When it comes to financing options for foreign buyers, Turkey offers a variety of avenues to secure funds for property acquisition. Many local banks provide mortgage loans specifically designed for non-residents, featuring competitive interest rates and favorable repayment terms. These financial institutions usually require detailed documentation, including proof of income and a good credit history, both locally and internationally. Additionally, foreign buyers can explore international mortgage providers who specialize in cross-border lending, offering more flexibility in terms of currency and loan terms. Understanding these financing options is crucial for making a sound investment and ensuring financial stability throughout the process.

For those considering alternative financing routes, developer financing presents an attractive option. Many well-known Turkish real estate developers offer installment payment plans directly to foreign buyers, often with zero interest rates for an initial period. This method can be particularly advantageous for individuals who might not meet the stringent requirements of traditional bank loans. Moreover, these developers frequently provide personalized payment schedules that can be tailored to align with the buyer’s financial situation, making the process more manageable and less stressful. Always ensure to conduct thorough research and get legal advice to understand the terms and conditions fully and to select the most beneficial plan for your investment.

Another noteworthy financing option is obtaining joint ventures or partnerships with Turkish investors. This collaborative approach can be particularly appealing for foreign buyers who seek to mitigate risks and share the financial burden. Such partnerships often result in mutually beneficial arrangements, providing both parties with enhanced resources and market insights. Additionally, these alliances can simplify the navigation of local regulations and property laws, leveraging the expertise and established networks of Turkish partners. Before entering into any joint ventures, however, it is crucial to draft a comprehensive agreement outlining each party’s responsibilities, financial contributions, and profit-sharing mechanisms to ensure clarity and prevent disputes. Consulting with legal and financial advisors prior to forming any partnerships will help safeguard your investment and foster a successful collaboration.

Navigating the Title Deed Transfer Process

Navigating the Title Deed Transfer Process in Turkey is an essential and meticulously governed step in acquiring property. At Gordion Partners, we prioritize transparency and accuracy in ensuring a seamless transfer. The process begins with a complete verification of the property’s legal status, confirming that there are no encumbrances or debts attached. This is followed by the preparation and submission of the necessary paperwork to the Land Registry Office, including the acquisition of a tax number and a property valuation report. Our expert advisors facilitate communication with authorized translators and legal representatives, guiding you through the signing of the transfer deed. Finally, once the payment of necessary fees and taxes is completed, the title deed is officially transferred to the new owner, marking the culmination of the property acquisition journey with peace of mind and legal assurance.

At Gordion Partners, our dedication extends to ensuring that every step of the title deed transfer process is executed with precision and clarity. One critical aspect is the involvement of a sworn translator for non-Turkish speakers, ensuring all parties fully comprehend the intricacies of the contract. Additionally, we liaise directly with local authorities and financial institutions to facilitate the transfer of funds securely and efficiently. During this phase, our team meticulously reviews all transaction details, cross-verifying each document to uphold the highest standards of compliance and accuracy. This rigorous attention to detail not only safeguards your investment but also expedites the approval process, ensuring a swift and successful transfer of ownership.

Beyond the technicalities of document verification and funds transfer, Gordion Partners also emphasizes personalized after-sales support as an integral part of the title deed transfer process. We assist clients in transitioning smoothly into property ownership by offering post-transfer services such as property management advice, utility setup, and ongoing legal support. Our commitment does not end when the title deed is handed over; we remain a reliable point of contact for any future assistance you may require. By entrusting Gordion Partners with your property acquisition needs, you gain not only a trusted advisor for the immediate transaction but also a long-term partner dedicated to safeguarding and optimizing your investment in Turkey.